Strong returns for Turkey’s dollar debt came during a turbulent year for the country’s assets © FT montage/Bloomberg/Getty Nuclear Regulatory Commission/CC/Flickr

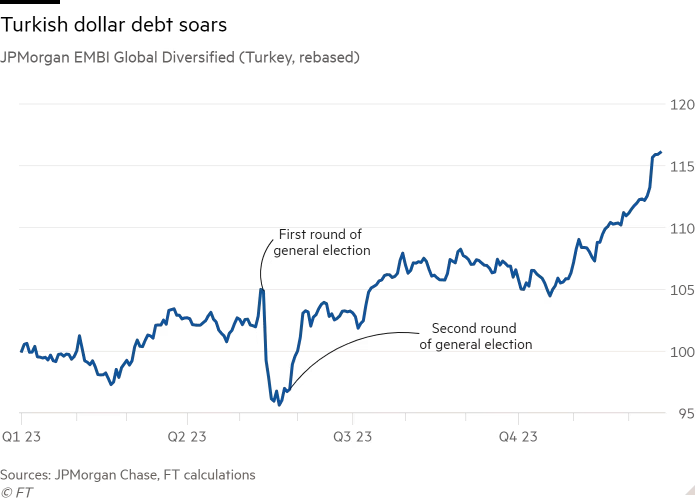

Turkish dollar bonds soar

Turkey’s US dollar bonds roared higher in 2023, posting the biggest gains of any top constituent of the leading emerging markets fixed income index as investors cheered signs that the country would pursue a more conventional policy course.Turkish debt included in the JPMorgan EMBI Global Diversified bond index, a gauge widely used as a benchmark by emerging markets fund managers, posted returns of about 16 per cent in 2023. The gains exceeded the 11 per cent return notched up by the wider index and marked the best performance of any of the top-10 constituents in the benchmark by weight.

The strong returns for Turkey’s dollar debt came during a turbulent year for the country’s assets. President Recep Tayyip Erdoğan was re-elected in May and surprised many economists and investors when he shifted away from the unorthodox policies that had sent the lira tumbling and left the central bank’s foreign currency war chest dangerously depleted.

He appointed Mehmet Şimşek, a highly regarded former Merrill Lynch bond strategist, as finance minister and ex-Goldman Sachs banker Hafize Gaye Erkan as central bank chief. Şimşek and Erkan have undertaken measures to rebuild the country’s foreign currency reserves, and raised interest rates sharply in a bid to slow inflation that is running at 60 per cent.

Still, concerns linger over whether Erdoğan, a longtime opponent of high interest rates, will stick with the new strategy ahead of key local elections next year. Adam Samson

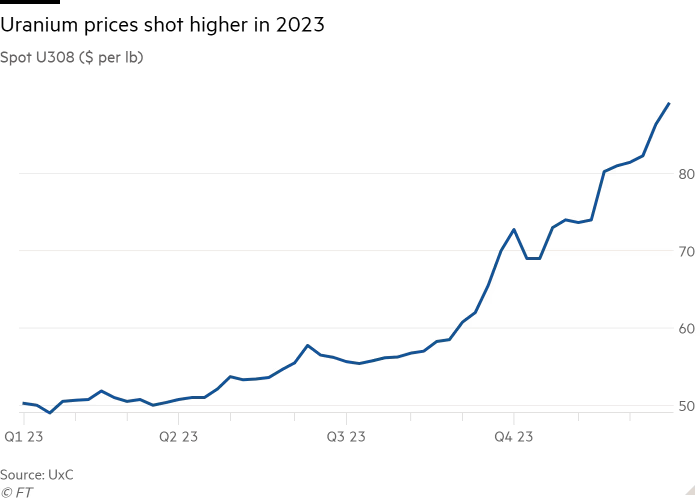

Uranium powers to 15-year high

The 2023 uranium bull run was a product of two long-term economic trends: the need for energy security and the drive towards net zero. A few very noisy bulls helped.Russia’s full-scale invasion of Ukraine in 2022 forced governments around the world to reconsider their dependence on energy imports, while growing pressure to reduce carbon emissions in line with international agreements has renewed attention on nuclear as a source of abundant, mostly clean energy.

The price of the element nicknamed ‘yellow cake’ reached a 15-year high in December of $90 per pound according to futures data from CME Group, up from $50 at the beginning of the year.

Uranium investors say it has further to go. The coup in Niger, which holds about 5 per cent of the world’s reserves, caused a minor supply scare in July as the threat of reduced availability of the material reverberated through the west.

Now Yellow Cake, a UK-listed investment company that buys and holds uranium, is warning that China is trying to sew up the market to meet its growing demand. And dependence on Russia, the largest exporter of the enriched uranium needed by nuclear power plants, is sounding alarm bells in Washington DC and elsewhere. Arjun Neil Alim

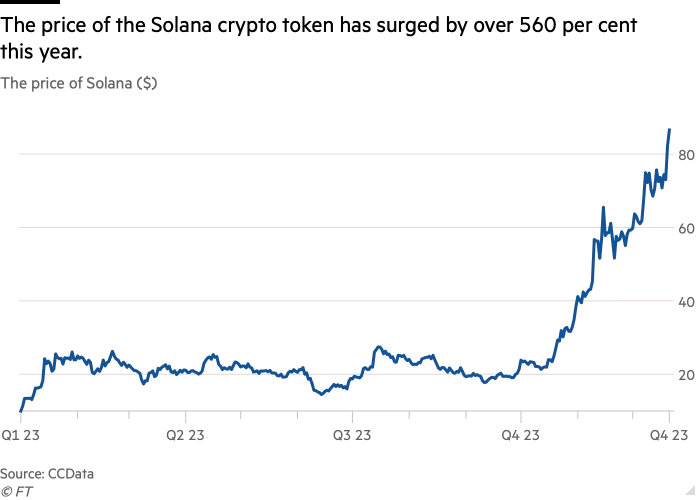

Solana back in the groove

Solana, a cryptocurrency once touted as the future of digital finance, roared back to life this year after the collapse of FTX wiped out more than 90 per cent of its value.One of Solana’s biggest backers had been Sam Bankman-Fried, the chief executive of the failed crypto exchange, who hyped its promise as a digital ledger that could handle thousands of trades a second, a technological obstacle that has been beyond many cryptocurrencies including bitcoin. When FTX collapsed, it was holding a large pile of Solana tokens. Along with the reliability issues that plagued the token, that pushed a price once as high as $250 down to just $13 in early 2023.

But Solana slowly began to fix its regular malfunctions — the last big one was February — and was gradually decoupled from Bankman-Fried in the eyes of investors. So far this year it is up 560 per cent to $87.

However the ambition that Solana could one day become the “Visa of the digital asset system”, in the words of one Wall Street bank, remains far off. Only 2 per cent of the $52bn investors have committed to projects for decentralised financial networks have been sent to projects built on the token. Scott Chipolina

Hidroelectrica shines through Europe’s IPO gloom

Few investors would have backed a Romanian hydropower company to top the list of Europe’s largest initial public offerings in 2023.State-owned Hidroelectrica’s $2bn IPO in Bucharest in July — Europe’s biggest since Porsche in September 2022 — beat out German drugmaker Schott Pharma and Italian gambling group Lottomatica, which raised $1bn and $660mn on their stock market debuts this year.

Shares in Hidroelectrica, one of Europe’s largest renewable energy groups, have since climbed by over a fifth, handing big gains to institutional backers including M&G Investment Management, Vanguard and Fiera Capital.

The IPO itself was “oversubscribed multiple times” at the offer price, according to Hidroelectrica, whose third-quarter net profit and revenue rose 42 per cent and 32 per cent year-on-year. Electricity production surged 38 per cent to 14,101 Gigawatt hours.

Yet Europe’s IPO market remains in the doldrums, with investor appetite limited by growing concerns of slowing economic growth. The promise of deeper pools of capital in the US meanwhile proved too alluring for the likes of chipmaker Arm and building materials group CRH, both of which are based in the UK.

Europe accounted for just 10.6 per cent of global IPO proceeds in 2023, behind China and Hong Kong at 45.5 per cent and the US at 18 per cent, according to data compiled by EY. George Steer

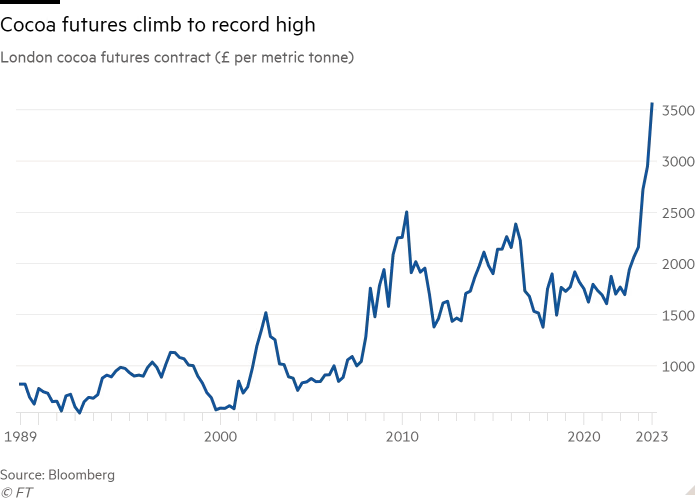

Cocoa prices leap

Cocoa futures have climbed to an all-time high as extreme weather has ravaged crops in West Africa, denting supplies and pushing up chocolate prices for global consumers.The Intercontinental Exchange’s London cocoa futures contract — a global benchmark that allows traders to buy and sell individual orders of up to 1,000 tonnes — now trades at £3,570 a metric tonne, up 91 per cent since the start of the year. In the soft commodity space, only orange juice has rallied more in 2023.

Analysts say heavier than usual rainfall over parts of Ghana, Nigeria and Ivory Coast, the world’s key cocoa supplier, have exacerbated the spread of black pod disease and delayed harvests. Traders now worry that hot and dry weather enhanced by El Niño could further crimp production early next year.

Even so, it is “difficult to justify the scale of the move higher” in cocoa prices, said Warren Patterson, head of commodities strategy at ING. “If supply from West Africa does not turn out to be as bad as feared, the market is in store for an aggressive downward correction.” George Steer

This article has been amended to correct the global share of the IPO market last year

Copyright : Financial Times.